Global trade is entering a new era of uncertainty. In this article, we examine how global tariffs, industrial trade conflicts, and shifting Supply Chains are challenging manufacturers and industrial companies worldwide. Amid rising trade tensions, quick fixes are no longer sufficient. Industrial companies need a long-term framework to build resilience and stay competitive. At the end of this article, you’ll find a brief self-check to help evaluate your organization’s current readiness and highlight areas for improvement.

A Rising Challenge: How Trade Disruptions Have Intensified Over the Past 5 Months

Over the last few decades, globalization has defined the rules of production and supply. Open markets, predictable trade relations, and global sourcing strategies allowed industrial companies to optimize costs and scale with confidence. But these rules are being rewritten rapidly.

A new kind of leadership has emerged – deal-oriented, politically assertive, and focused on shifting global trade balances. The result: growing uncertainty in industry around tariffs and the free movement of goods.

Tariffs, once considered temporary disturbances or negotiation tools, have become permanent stress tests for industrial players. What was once an exception is now the new normal, with no indication this trend will reverse soon. As geopolitical tensions rise and protectionist policies resurface across major economies, companies must ask: Are we structurally prepared for this new reality, or merely reacting to it?

Many companies still operate on outdated assumptions about trade stability. In a world where volatility is constant, this leaves them dangerously exposed. Recognizing change alone is not enough; navigating it with clarity, adaptability, and foresight separates resilient companies from vulnerable ones.

In such a dynamic environment, traditional tools and responses are no longer sufficient. Building resilience today means thinking beyond the usual levers and designing organizations structurally equipped to withstand and even benefit from disruption.

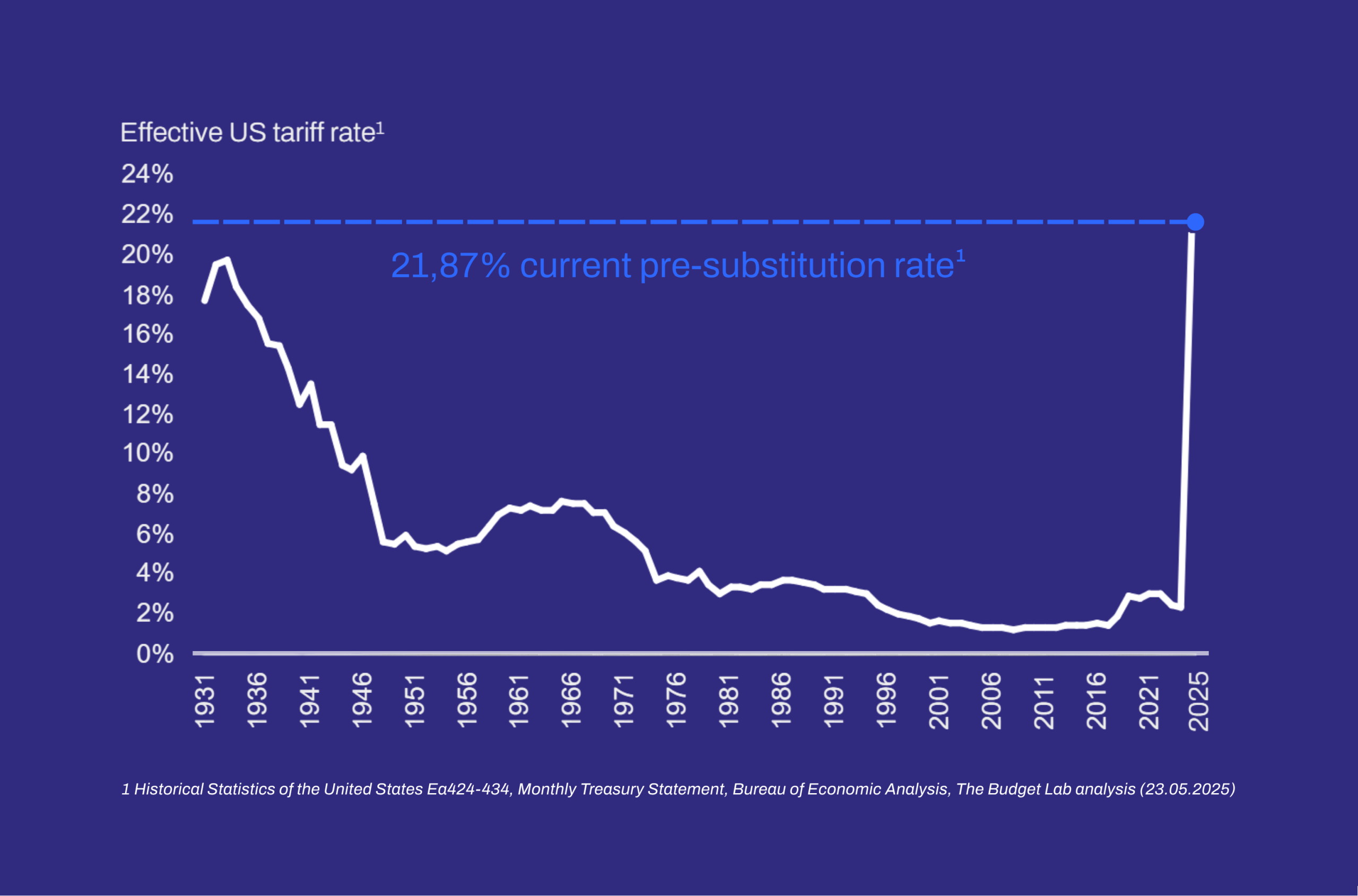

Industrial Tariffs Are Reaching Historic High

To understand the urgency of the situation, one must look at the numbers. In May 2025, the average U.S. tariff rate soared to 21.87%. This marks the highest level in over a century, more than ten times higher than just a year ago, when it stood at 2.42%.

For many industrial companies, this dramatic jump does more than pressure margins, it challenges the very foundation of their business models. Contracts were signed and pricing calculated under previous conditions. Tariffs now apply on top of these agreements—unexpected, non-negotiable, and financially damaging.

Companies face difficult choices: absorb the cost and take a loss or walk away from the deal and forgo the revenue. Neither is sustainable, revealing how even well-run organizations remain unprepared for rapid trade policy shifts.

But it doesn’t stop there. The U.S. has imposed a 33% effective tariff rate on Chinese imports. In response, China has retaliated with its own set of tariffs, locking both economies into a dangerous escalation loop. Meanwhile, the EU is bracing for a potential 50% tariff on all its exports to the U.S., set to begin as early as July 9th. The political climate is increasingly unpredictable, and trade agreements that once offered stability are now fragile at best.

What we’re witnessing is not an anomaly. It’s a structural shift – one that requires a structural response.

Which Industries Face the Greatest Exposure?

Not all sectors face the same level of exposure. For some industries, the current wave of tariffs represents more than just higher costs, it threatens their fundamental competitiveness.

Among the hardest-hit sectors are:

- Metals and raw materials: These products often form the base of broader Supply Chains, making tariff increases here especially painful.

- Electrical equipment and machinery: Complex cross-border value chains make them highly sensitive to even small trade disruptions.

- Textiles and apparel: Already operating on thin margins, any added cost can tip production toward unprofitability.

European industrial companies are facing compounded risks. Their export strengths overlap significantly with the product categories now subject to U.S. tariffs. This means that the impact is not only deep but also broad, spanning across core industries that form the backbone of many national economies.

Moreover, some companies assumed that shifting production closer to their end markets would provide insulation. But recent trends show that even geographic proximity is no longer a reliable shield. Tariffs are being applied in ways that defy traditional logic, targeting strategic sectors, not just trading blocks. Uncertainty has become systemic.

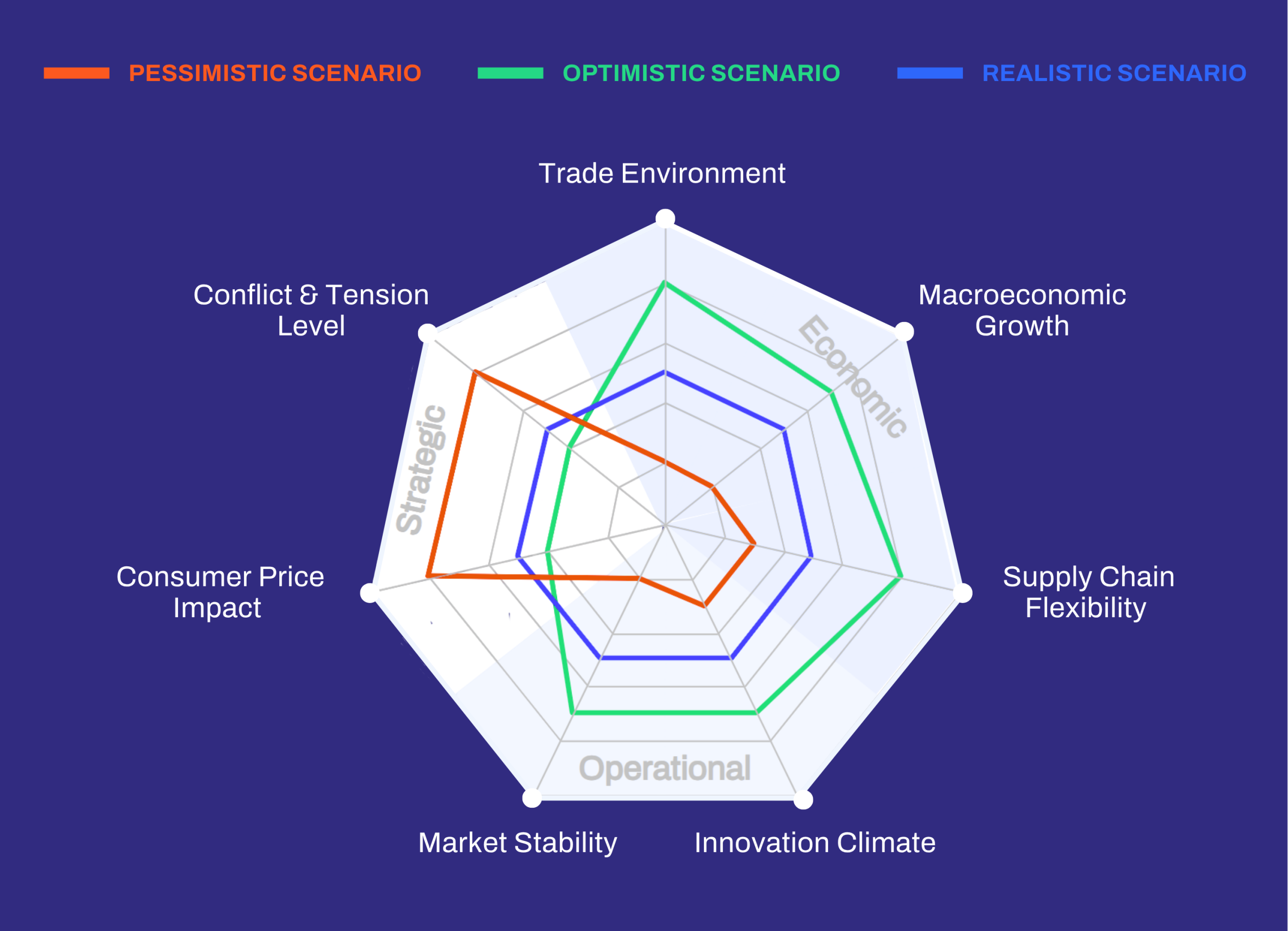

Industrial Scenarios for Navigating Global Trade Uncertainty

Given the volatility, companies must prepare for a range of outcomes. Predicting the future is impossible, but preparing for multiple futures is not.

We see three plausible macro-scenarios emerging, with our experts currently assigning the highest likelihood to the “realistic scenario”:

1. Pessimistic Scenario

Trade tensions escalate sharply. U.S. tariffs on Chinese goods skyrocket to over 200%. In retaliation, the EU and other major economies impose widespread countermeasures. The resulting global trade conflict triggers a broader economic slowdown, with companies facing not just higher costs, but collapsing demand.

2. Realistic Scenario

The status quo persists. Tariffs on Chinese goods remain high, with slight reductions in select areas. Suspended tariffs pose a constant latent risk. Bilateral deals with countries like the UK, Canada, and Japan offer limited relief. The EU introduces moderate countermeasures, but a trade war is avoided. Supply Chains stay under pressure yet remain stable enough for strategic adjustments.

3. Optimistic Scenario

Diplomatic breakthroughs lead to bilateral agreements and a reduction in tariffs. U.S.-China relations begin to normalize by the second half of 2026. The global economy breathes a collective sigh of relief, but companies that have adapted remain more competitive than those that have waited it out.

Each of these scenarios comes with distinct economic, operational, and strategic implications. What matters most is not which path becomes reality, but whether your company is structurally prepared for any of them.

Why Industrial Players Need Strategic, Not Just Tactical Responses

Many companies are reacting tactically – passing tariff costs to customers, reshuffling Supply Chains, or shifting toward local production. While these responses may buy time, they often come at the cost of added complexity, reduced scale efficiencies, and new vulnerabilities.

- Price Adjustments: 54% of companies pass tariff-related costs on to customers – at least partially – without fully understanding the underlying margin risks.

- Supply Chain Modeling: 68% engage in rapid supplier diversification or relocation, but without a clear resilience strategy, this can raise costs and introduce instability.

- Localization: Regionalization may reduce exposure, but it can also limit innovation and increase dependency on domestic risks.

Short-term fixes are not enough. Real competitive advantage lies in building systemic resilience.

Building Long Term Resilience in Industry

Resilience is not built overnight. It is the result of deliberate planning, cross-functional coordination, and long-term commitment. At Avencore, we recommend a structured, three-phase approach:

- Achieve full cost transparency under new tariff regimes

- Secure short-term supply continuity

- Identify margin erosion risks before they affect performance

- Rebalance Supply Chain footprints to diversify exposure

- Increase agility in procurement and production planning

- Decouple critical dependencies on single markets or suppliers

- Build strategic resilience into organizational design

- Develop internal governance models for continuous cost-performance control

- Turn trade volatility into a source of competitive advantage

Each phase builds on the previous one. It’s a journey – from reaction to adaptation and ultimately to transformation.

Where Does Your Company Stand?

Before making the next move, industrial leaders should reflect:

- Do we have full visibility on tariff exposure across our value streams?

- Are current Supply Chain adjustments tactical fixes or part of a broader strategic redesign?

- Have we modeled multiple trade scenarios with clear action plans?

- Are we treating trade volatility solely as a risk, or also as an opportunity?

If any answer is unclear, now is the time to act, to build resilience, sharpen strategy, and stay ahead in a shifting global landscape.

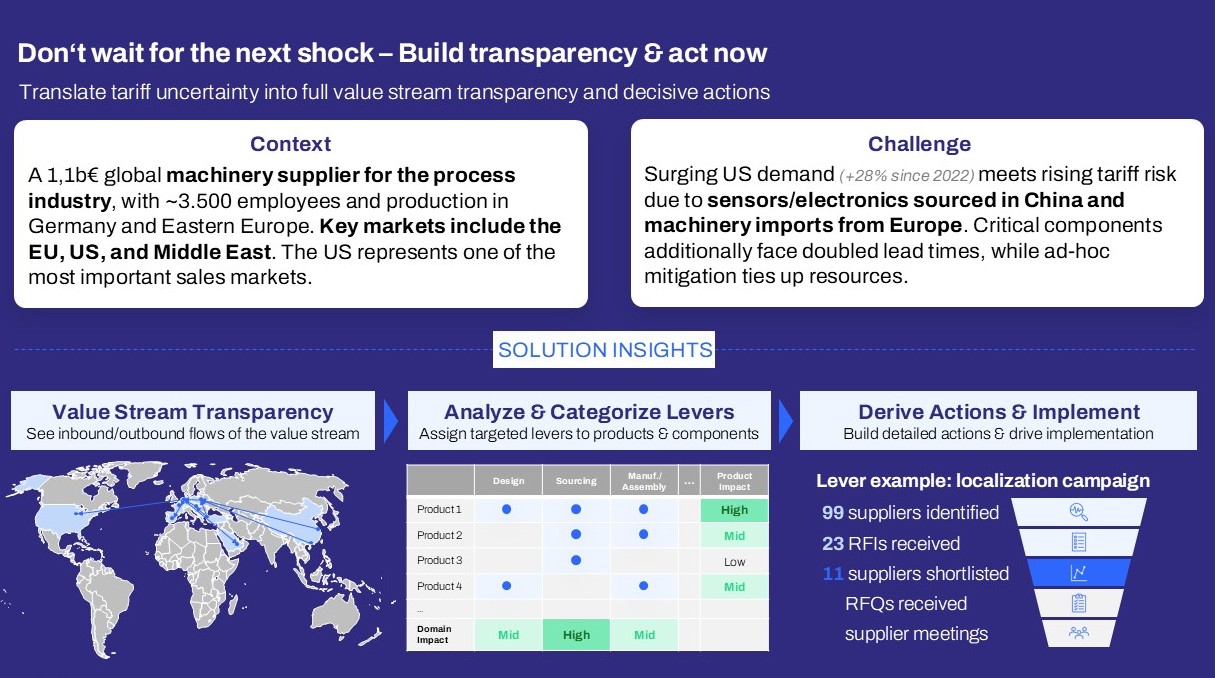

Avencore as Your Partner

As transformation experts, we at Avencore help industrial firms move beyond short-term firefighting. Our end-to-end methodology covers every stage of the resilience journey. A few of our proven methods are:

- Rapid tariff impact diagnosis

- Supplier risk and exposure mapping

- Value stream transparency and scenario simulations

- Targeted make-or-buy decisions and network redesign

- S&OP optimization and cost governance framework.

We don’t believe in one-size-fits-all solutions. Instead, we co-develop strategies that are tailored to your organization, industry, and competitive context. Whether you’re at the beginning of this journey or already deep into it, our team brings the experience and tools to help you go further, faster.

In a world defined by disruption, waiting may be the riskiest strategy of all. The industrial companies that emerge strongest will be those who treat volatility not as a threat, but as an opportunity to build smarter structures, tighter cost control, and long-term resilience.

Contact Avencore today to start building a strategy that turns global trade disruption into a competitive.