The European automotive industry faces its greatest transformation since mass production began: transitioning to electric vehicles while competing with new market entrants. This analysis explores how manufacturers are leveraging Design-to-Value principles to overcome these unprecedented challenges.

The context: a regulatory-driven revolution

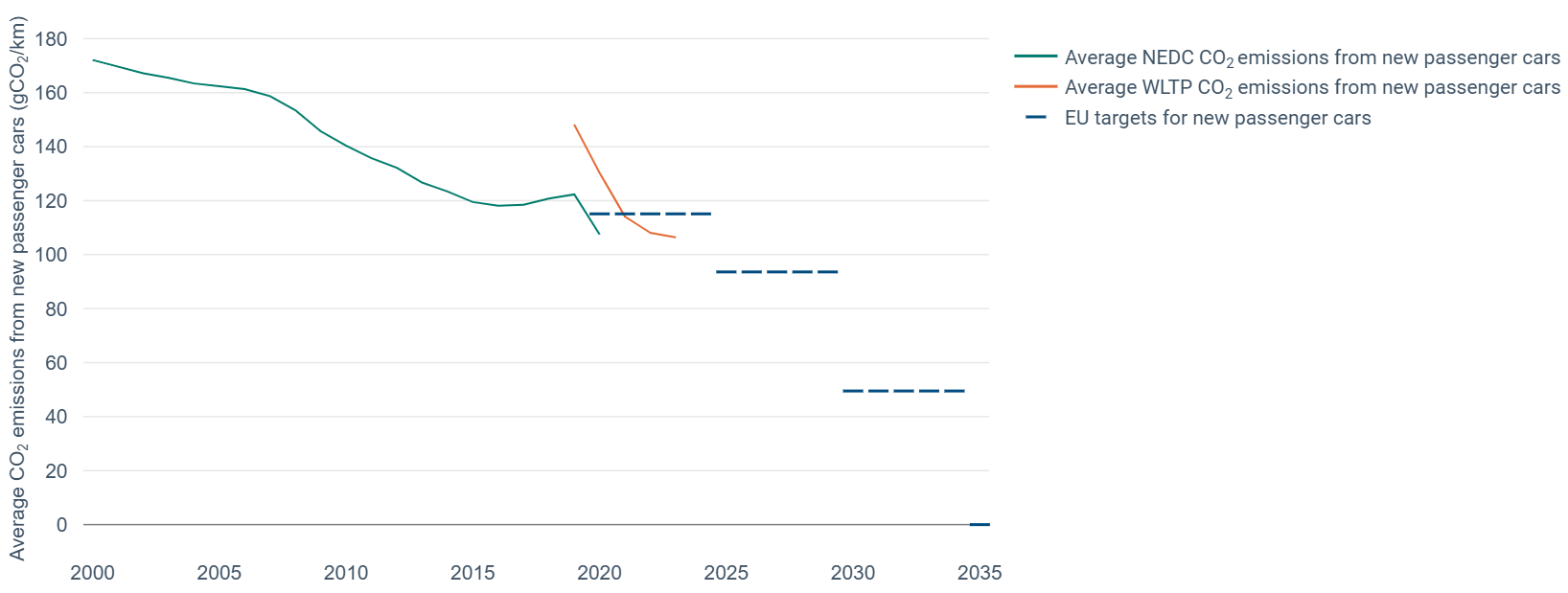

The European automotive industry is undergoing a profound transformation, driven by the EU’s ambitious CO2 reduction targets for the transportation sector. Carmakers are required to reduce passenger vehicle emissions from an average of 95g/km to 81g/km by 2025, 50g/km by 2030, and ultimately 0g/km by 2035. This will effectively phase out Internal Combustion Engine (ICE) vehicles, which still represent over 85% of the market.

Source: European Environment Agency – https://www.eea.europa.eu/en/analysis/indicators/co2-performance-of-new-passenger/average-co2-emissions-from

The industrial and economic consequences of this transition are significant. Many European car and component manufacturers reported declining financial results in 2024, leading to job cuts and calls from industry leaders to slow the pace of change. Understanding the operational impacts of these directives and examining recent industrial challenges provides context for the strategies being applied in the automotive sector, such as Design-to-Value.

With ICE technology improvements reaching their limits and alternative technologies like hydrogen still maturing, Battery Electric Vehicles (BEV) have emerged as the primary solution. The BEV market share must grow from 15% in 2024 to at least 25% by 2025.

Learning from China’s electric journey

China has demonstrated how policy-driven incentives can accelerate the adoption of BEVs. Between 2009 and 2020, China’s central government allocated nearly $30 billion in subsidies for electric vehicles, leading to a surge in production from 500 units in 2009 to 5.4 million in 2023 (57% of global production).

Moreover, China leveraged this transition to establish technological and capacity leadership in key areas of the BEV supply chain, including battery technology and raw materials. However, with domestic demand slowing since the COVID-19 pandemic, Chinese car and battery manufacturers are now targeting Europe, intensifying competition for local players.

Challenges facing European carmakers

The shift to BEVs presents multiple challenges for manufacturers and consumers alike:

- Range anxiety: BEVs generally offer lower autonomy than ICE vehicles, and longer recharge times require changes in consumer behavior.

- Charging infrastructure: Networks are expanding but remain sporadic, particularly in rural areas, leaving consumers uncertain about accessibility.

- Cost: BEVs cost approximately 40% more to produce than ICE vehicles with similar specifications, largely due to high battery costs. This makes them less affordable, even with subsidies.

Design-to-Value as a strategic lever

This is not the first time that the automotive industry has faced external pressures that drive up costs and threaten sales volumes. As the pioneer of both Fordism and lean manufacturing, the industry has a long history of adapting and striving for performance.

This relentless drive for performance has moved beyond traditional operational excellence to encompass every aspect of the business, from product development to customer engagement.

Not surprisingly, this industry has been one of the early adopters of the Design-to-Value approach. This approach aims to maximize overall product value and customer satisfaction by balancing performance and cost, providing a more holistic approach to product development.

Recent examples highlight how Design-to-Value is reshaping BEVs:

- Autonomy: ICE vehicles have maintained a range of around 700 km for decades, thanks to energy-dense fuel. Achieving this with batteries would require expensive chemistry and significantly increase vehicle weight. To balance cost and range, many BEVs now target 400 km, using more affordable technologies like LFP batteries, while premium models focus on maintaining higher ranges to meet customer expectations.

- Segment: for urban vehicles, manufacturers are shifting from small, highway-compatible cars (e.g., Twingo, Smart) to city-specific designs like the Citroën Ami and Renault Duo. These vehicles, while not highway-capable, are significantly cheaper and better adapted to urban use.

The path ahead

The European automotive industry is facing an exceptionally challenging situation with a fast-paced, regulation-driven technology shift towards a solution that is industrially and technologically dominated by China. Design-to-Value is now more than ever a critical lever for the European automotive industry to remain competitive. To succeed, this approach must extend beyond its traditional focus on products to redefine project strategies of the industry, particularly in the following areas:

- Batteries: with batteries accounting for almost half of material cost, and ongoing technology leaps (NMC to LFP chemistry, solid-state and other types of chemistry), designing future batteries to meet customer performance expectations requires a deeply integrated approach that goes beyond simply replacing fuel.

- Supplier integration: from batteries (for BEV) to software and sensors (for autonomous or connected vehicles), innovations and technological breakthroughs often rely on third-party suppliers. These partners must be central to the project design and development phase to maximize their potential and ensure products are optimized using the best available technologies.

- Customer-facing entities: the scale of the upcoming changes reshapes how customer needs are understood. Segment definition through Design-to-Value can enable paradigm shifts towards technical solutions that address new customer trends – such as pay-per-use models.

In today’s globalized economy, industries across all sectors face similar disruptions. By embracing tailored and network-wide approaches like Design-to-Value, companies can unlock new opportunities for growth and sustainability.

Learn more about how Avencore supports its clients in applying the best value creation leverage through a six-step process : From Design-to-cost to Design-to-Value

Fabrice Vigier, Mathieu Imbert, Julie Hazard

Read More: